Aliexpress

ASOS

Cafago

Canon

ChicMe

Clarks

Cotosen

Crate & Barrel

Creator Tools

Creditgo CZ

DHgate

Ebay

- Show all

- Popular

- Hottest

- Expired Soon

- Show all

- Choose category

- All categories

- Aliexpress

- ASOS

- Cafago

- Canon

- ChicMe

- Clarks

- Cotosen

- Crate & Barrel

- Creator Tools

- Creditgo CZ

- DHgate

- Ebay

- EPL DIAMOND [CPS] US

- Eshko.by

- Geekbuying

- Geekbuying PL

- Giftmio

- Gogreen

- HP

- Iherb.com

- Joom &BY

- Jumbo AE

- Kaspersky

- Kinguin

- Laroche

- Lenovo

- Lightinthebox

- Lingualeo

- Love Republic

- Mebelshara

- Miravia ES

- Novakid

- Officesuite

- Old Navy

- Panasonic

- Productstar

- Qatar Airways

- Salamander

- sbermarket

- Skyeng

Liquid Calcium with Magnesium, Natural Orange Flavor

Apple Pectin, 700 mg

Garlic Oil, 1500 mg

Shaha 5 toothbrush, Non Nylon, Tapered, Soft and Ultra fine bristles

Honeysuckle Rose Conditioner, Moisture Intensive, Dry

Green Magma, Barley Grass Juice

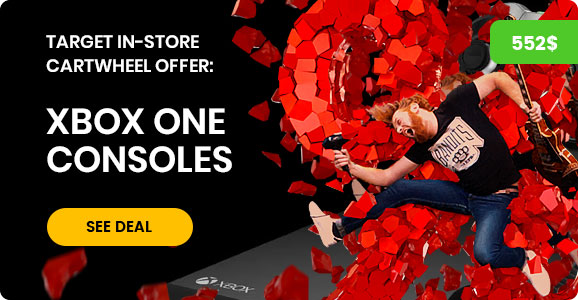

Plant-Based Daily Superfood + Probiotics and Digestive Enzymes

Amazing Grass Green SuperFood Original

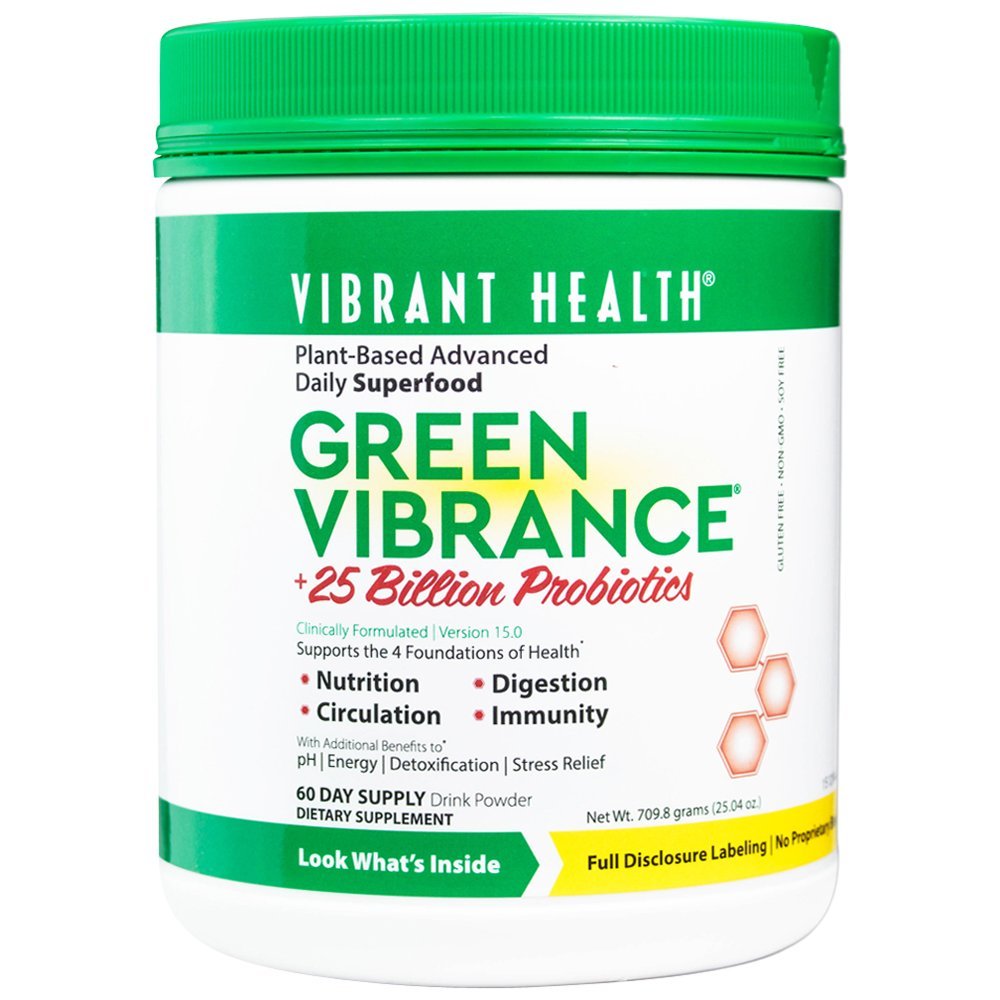

Vega One All-in-One Nutritional Shake, Chocolate

Best deals on this week

HIGH TICKET OFFRE TODAY

How to use Coupons

Discount Code

You will receive a code (eg AWESOME) that you must enter before you can complete your purchase (usually on the Cart screen or Payment screen) – the field for entering the discount code will be labeled “Discount Coupon”, “Discount Code” Promotional ”, etc. In some stores you will need to be logged in to be able to view this field.

Discount Link

In this case a code will not be required – the discount will be automatically applied to the products of the site, that is, the prices of the products will already appear with lower values. Stores may have 2 different behaviors: (A) some will show discounts on the value of products in the listing (may show “from / by” or show only the reduced price.

Offers

Redeal we also list the best deals that stores advertise every day. In such cases, our coupon will not always reduce prices further (which are already well reduced because of these discount actions).

Read is a completely free site that offers discounts through coupons and offers from leading national and international online stores. Every time you make a purchase over the internet, we help you save money. As well? We deal with the best e-commerce companies and search the internet to find and offer exclusive coupons and special discounts at your favorite online stores.